How "Radio" Can Capture A Bigger Piece Of The $12B Political Ad Pie

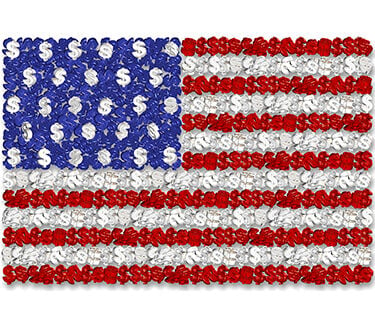

Radio is forecast to book $400 million in political advertising in the 2024 election cycle, according to Vivvix CMAG, which has been tracking election ad spend since 1996. That amounts to just over 3% of the projected $12 billion to be invested across all media, far less than the share radio gets from other major categories.

To capture a bigger piece of the pie, the radio industry needs to collaborate in a more unified way to elevate its message to campaigns and political consultants, according to Steve Passwaiter, VP, Growth and Strategy and Senior Advisor to Vivvix CMAG. “There's enough money in this vertical now that it deserves a strategy and a plan with milestones,” says Passwaiter, a former radio ad seller.

Pat McGee, Executive VP of Political Strategies at Katz Radio Group, says the rep firm continues to collaborate with its broadcast partners, consultants and buyers to advocate for increased radio spend. “All indicators show a healthy demand for audio this upcoming election cycle,” he says. “There is no better reach vehicle than what radio offers, and I think campaigns are realizing that more and more.”

Passwaiter suggests radio take a page from the TVB playbook. The trade association for the local broadcast television industry has a consistent presence in DC among the political advertising decision makers. Convincing them of radio’s ability to reach and motivate swing voters requires going beyond the political ad agencies to meet with members of the political parties and their consultants. “There's so much money here in Washington, but it's going to take a different effort to pry it loose,” he says.

Developing Relationships In Washington

McGee says Katz spends a lot of time and resources working with key influencers like the American Association of Political Consultants and organizations “working to affirm that audio has its seat at the table and our story is being told. It’s an ongoing process of relationship development, working to be a sought-after source of both information and a pathway to victory. We spend time at many annual and regional conferences integrating our platform into political ecosystem to make sure we are aligned to part of any campaign’s media plan, and frankly, securing more of it.”

With Republicans having only a slight majority in the House and Democrats barely in control of the Senate, there’s a lot at stake for both major political parties. “That kind of competition, whether we're talking about automobiles or politicians, spurs spending,” Passwaiter says.

In the 2022 midterm election cycle, Nielsen VP of Cross Platform Insights Tony Hereau made the case to political operatives that they can communicate with difficult-to-reach swing voters by using radio. An over reliance on TV leads to campaigns becoming oversaturated with heavy TV viewers, who tend to be older registered voters, while missing light TV viewers and the growing number of Americans who watch zero broadcast or cable TV. These zero/light viewers accounted for 45% of all voters in the 2022 midterm elections, according to Nielsen Scarborough data. AM/FM radio, meanwhile, reaches 82% of voters who watch little to no TV, with higher reach among Black and Hispanic voters, and closer to nine in 10 working moms, dads, GenX-ers and baby boomers.

Getting campaigns to change their traditional playbook of allocating the largest piece of their budget to TV takes time, Bouvard says. “There is a herd mentality, not an innovator mentality of going somewhere else where we can stand out and get noticed.” After all it took Procter & Gamble to dive into radio for others in the consumer packaged goods industry to take notice of the medium. Says Bouvard, “Which political campaign is going to be the P&G that's going to say, there's amazing reach and incredibly affordable CPMs in radio?”

As with CPG and other categories, research and analytics plays a growing role in how political ad dollars are placed. “Cycle after cycle we learn more about what elements of a campaign drive the win and how audio plays a role,” says McGee. “We can then increase advocacy and showcase radio’s power to drive persuadable voters to their campaign or cause back to the political community.”

With political advertising pacing at twice the rate of the 2020 cycle, now is the time to get in front of the political decision makers in Washington. “These folks are going to start to get really busy and by the time you get into 2024, they just won’t have the time,” Passwaiter points out. “The time to sell the medium is in the off year, where you can get the full attention of people.” –

Paul Heine